Manually Add Provider Tax Adjustment to Invoice

02.02.2017

Billing, Support Posts

Sometimes you get an ERA or EOB with a negative adjustment for the provider tax. If you are manually entering in remittance advice, you’ll need to complete an extra step to add in a second adjustment.

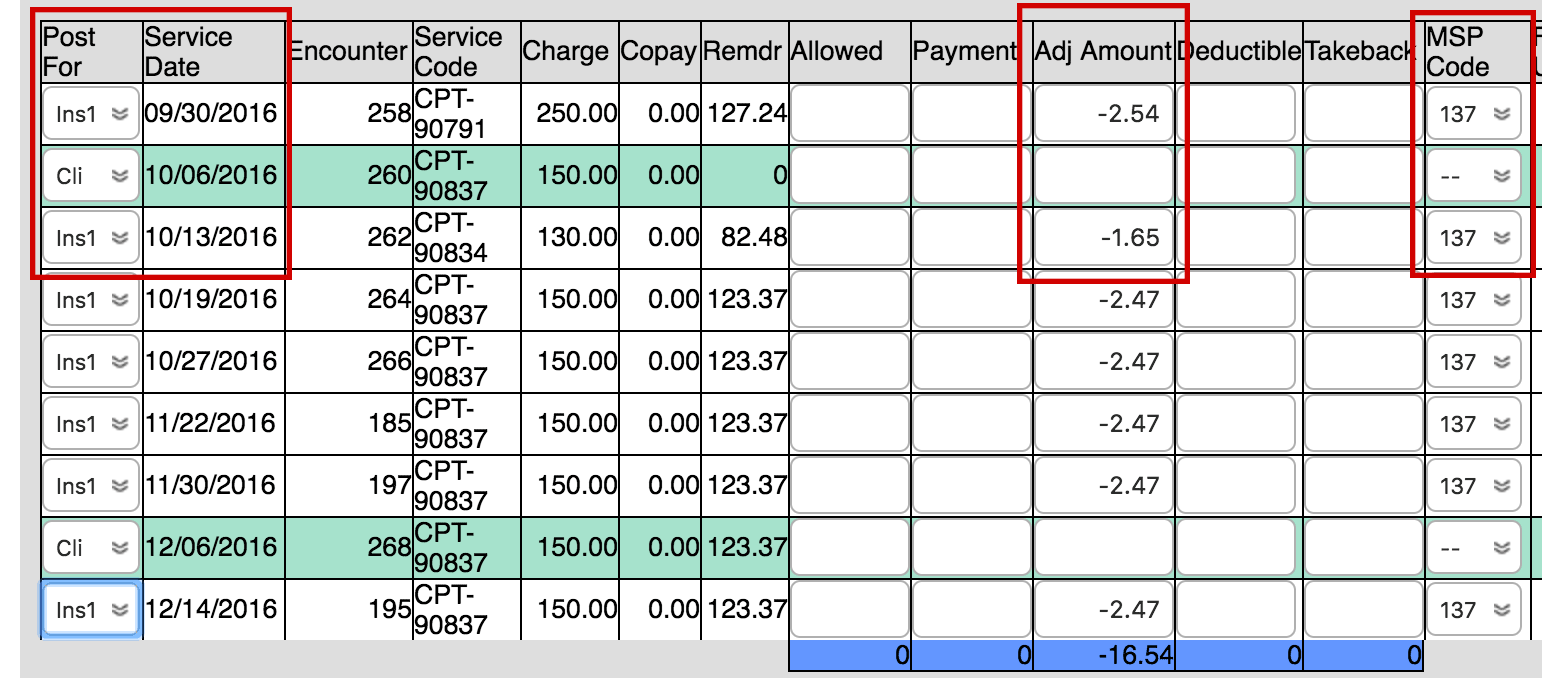

When you are done manually entering in the initial payment information and adjustment from the primary payer:

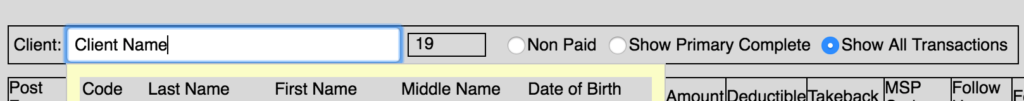

- At the bottom of the payment screen, enter the client’s name again.

- Select the client

- Choose “Show All Transactions” where you entered the client name

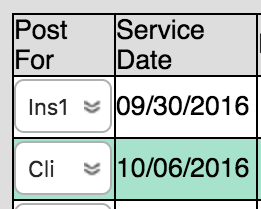

If the client has only one insurance, all the paid encounters should be green. - Change “Now Posting for:” to Ins1 for all encounters you are updating (they should turn white)

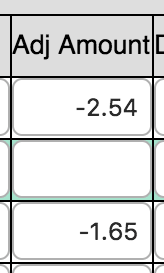

- Enter the negative adjustment amount

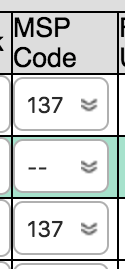

- If this is for the provider tax, select “137” in the MSP Code list

- When you have done this for all encounters on the EOB, click the “Modify Payments” button.

This tutorial applies to advice from the primary payer. If the advice is coming from secondary, the process would be the same except you’d choose “Ins2” instead of “Ins1” in step 4.